Oops, we stopped geoengineering

21. Meat, ship tracks, and shalennials

Note: The views expressed here are the author’s own and do not reflect the views of Energy Impact Partners.

Meat is a carbon-based fuel

Back when I worked at ARPA-E, I got interested in greenhouse gas emissions related to meat. I gave a talk about it, some cattle farmers had a few words for me, and then we funded a project to address some R&D challenges facing the field.

My argument was roughly:

Meat is a carbon-based fuel with a ~6 gigaton CO₂e footprint.

More people are eating more of it.

There are no substitutes — even plant-based meat — that will dramatically reduce animal meat consumption.

So, reduce emissions by giving people what they want: animal meat. Just grow it in efficient factories, not inefficient animals.

It’s very hard to simulate animal meat, so get out of the simulation game and dream up new products.

It was a fun argument to work on, and I still stand by it. But along the way, one thing I wish I’d spent some more time on was the parallels between the meat industry and the energy industry. I think they’re pretty interesting. Both rely heavily on natural resources. Both operate in commodity markets. Both are dominated by very large players with ties to most of the world’s governments. And at the end of the day, both produce energy – one that engines eat, the other that humans eat.

Which brings me to one of the stranger parallels between energy and meat: the big three fossil fuels look a lot like the big three meats. As people around the world have grown richer, they’ve begun to consume more of both fossil energy and meat, and as economics and preferences change, so does the product mix.

There you go. Beef is coal, pork is oil, chicken is natural gas. Coal/beef and oil/pork have had their ups and downs, but poultry/natural gas have come roaring onto the scene over the last few decades. I’ve never quite known what to do with this information. The best I can do is tie them together via the macroeconomic growth story. But it seems worth thinking about.

Much has been written about our shift toward natural gas, but there’s been less coverage of our preference for poultry. We’re producing a lot of it! This brings me to two places:

Chickens are smaller than pigs or cows, so you have to slaughter many more of them. In 2021, we slaughtered 332 million cows and 1.4 billion pigs — astronomical numbers. But to serve poultry demand, we slaughtered 74 billion chickens. From an animal welfare perspective, that is a tough figure to sit with.

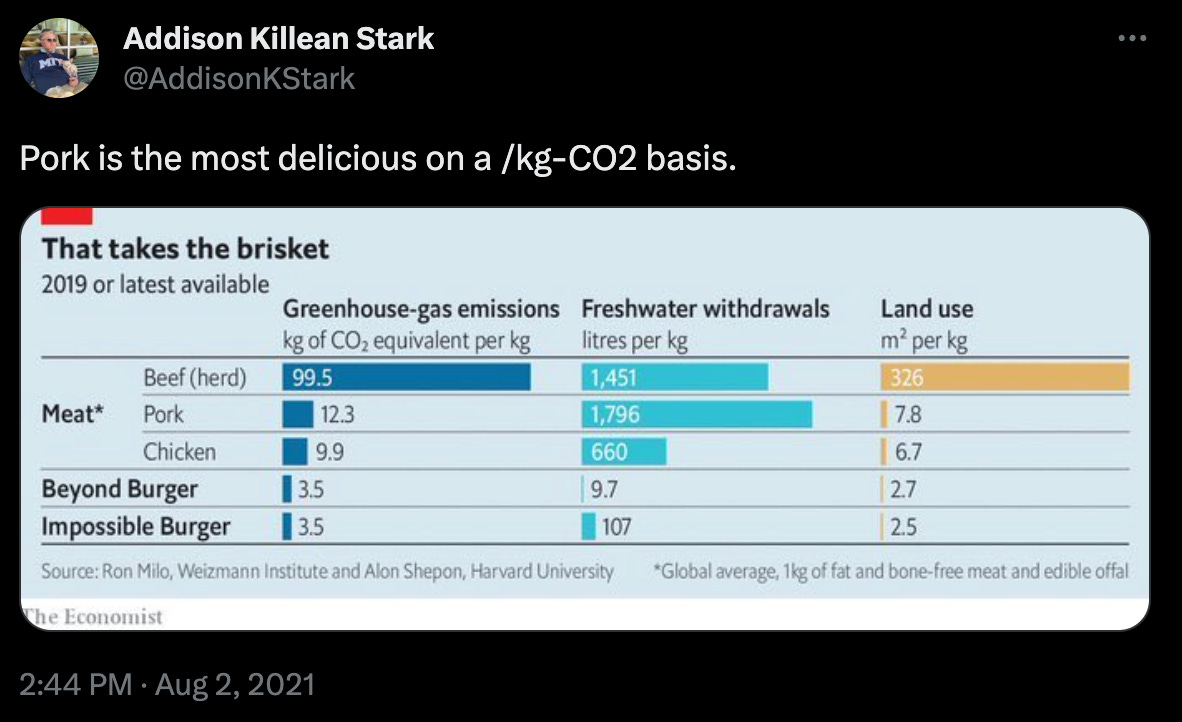

Chickens and pigs are much more climate-friendly than cows, chicken slightly more than pork.1 This is analogous to the natural gas story: overall emissions are up, but emissions per unit (Btu or kg meat) are down.

On balance, what do you do with all this? I don’t know, maybe optimize for pork. It’s pretty good.

Termination shock?

A while ago, we talked about the idea that we’re already geoengineering the planet. The theory was that despite trepidation about sulfur-based geoengineering, sulfur dioxide emissions from ships added up to create a measurable cooling effect. But in 2020, we suddenly stopped. Maybe that was bad? Here was the thinking:

The last bastion for high-sulfur fuel was the shipping industry, which powers its vessels with the heaviest, dirtiest fuel oils out there – about 3.5% sulfur by weight. But even this is changing, with the International Marine Organization banning high-sulfur fuel in 2020.

But sulfur also has an effect on the climate: cooling. Sulfur aerosols cause clouds to become more reflective, sending incremental sunlight back into space and preventing surface warming. Inspired by sulfur-rich volcanic eruptions that have temporarily cooled the planet, like that of Mount Pinatubo in 1991, sulfur aerosols are now one of the main proposals of the geoengineering community.

So, in an attempt to clean up fossil fuels, we’ve actually made them into better global warmers. We’ve traded an environmental problem for a climate problem.

Well unfortunately, it looks like the absence of sulfur is definitely having a negative effect. Here’s a recent story published in Nature:

In 2020, the International Maritime Organization cut the amount of sulfur permitted in fuels burnt by ocean-going ships. The change intended to reduce air pollution by reducing vessels’ sulfur oxide emissions. But studies have suggested that it has also increased global warming, because sulfur particles affect the chemistry of clouds and help to cool Earth’s climate.

Michael Diamond at Florida State University in Tallahassee analysed satellite data to explore cloud changes in a shipping corridor in the southeast Atlantic Ocean between 2002 and 2022. The size of atmospheric droplets, which can serve as seeds on which clouds can form, in the corridor decreased after the sulfur regulations went into effect in 2020.

That change meant that clouds did not brighten as much as they would have, had there been more sulfur particles in the air. The net result was less cooling than before the regulations — an effect that could be happening worldwide.

This article references a research paper by Michael S. Diamond from Florida State, titled “Detection of large-scale cloud microphysical changes within a major shipping corridor after implementation of the International Maritime Organization 2020 fuel sulfur regulations.” Here’s the key figure:

In this study, Diamond looked at shipping routes off the coast of Angola. He measured a quantity called rₑ, or the cloud drop effective radius. Lower (yellower) rₑ means means brighter clouds and more sunlight reflection. The left column shows data observed over stretches of time between 2002 and 2022. Then he used a statistical trick called “kriging” to estimate what the area would have looked like in the absence of shipping. That’s the center column. Then in the right column, he subtracted one from the other to isolate the effect of ship tracks. What we see as a result is pretty stark: less sulfur in shipping fuel, less sunlight reflection, less cooling. In Diamond’s words:

A decrease in the rₑ perturbation is detected at greater than 99 % confidence in the austral spring and at greater than 95 % confidence in the annual mean, whereas decreases in the Acld perturbation are only significant at the 90 % confidence level in the austral spring and within the interquartile range in the annual mean. We thus conclude that the effect of the IMO 2020 regulations has been clearly detected in the large-scale cloud microphysics and that there is strong evidence for a decrease in cloud brightness, although more years of data may be required for unequivocal detection of changes in overcast albedo.

That’s the bad news. But I wonder if there isn’t a silver lining here? We essentially did a small termination shock to ourselves — conceding an extra 0.1-1 Watt per square meter in shipping lanes — and it didn’t result in catastrophe. What if we tried doing the opposite, but in a more responsible way that doesn’t have the poisonous effects of sulfur dioxide? With the usual caveat that climate science is complicated: seems bullish for marine cloud brightening.

Shalennials

Weirdly, it might be a good time to start an oil company. Sure, oil is out of favor, but we’re going to continue using it for a while. Sure, ESG investing has grown, but so has anti-ESG. And some oil companies count as ESG anyway. And sure, oil prices dipped negative in 2020, but they’ve been over $70 per barrel consistently for the last two years.

Well now, there’s another reason to start an oil company: you’ll have fewer competitors.

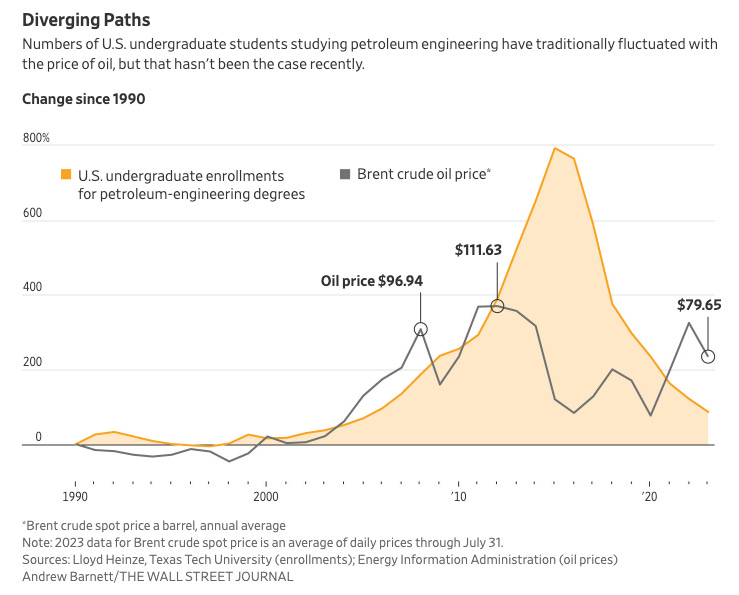

As shown in this WSJ graphic, fewer students are studying petroleum engineering now than at any point over the last decade. As a result, fewer will enter the workforce over the next couple of years. This kind of swing is known to happen in the oil industry, but it normally tracks with boom and bust cycles. Here, it looks like petroleum engineering degrees and oil prices have started to decouple. Talent is leaving the field faster than demand is drying up.

This seems bullish for the climate, but also like a decent market opportunity? If you A) think that there are still viable businesses to be built in oil and gas (spoiler alert: there are) and B) can stomach criticism, then there’s almost never been a better time to get in the game. While your classmates are struggling to make DAC pencil out, you can outcompete the 60-somethings running the show in Midland.

Here’s a millennial duo named Will Hickey and James Walter who have done just that:

Today [co-CEOs Hickey and Walter] make the big decisions together at Permian Resources, though Hickey, age 36, primarily handles operational and engineering matters, while Walter, a year younger, manages the company’s finances and business development. If they worked in the tech industry, no one would bat an eye at their ages—they might not even be considered young. But most CEOs of Texas-based oil companies are in their sixth decade or beyond. Even more notable is the youthfulness of the two hundred employees Hickey and Walter have assembled. “I’m probably one of the more seasoned people here,” said Matt Garrison, the company’s COO, “at the ripe old age of forty-one.” …

How does a youthful oil company operate differently? Hickey points to a willingness to use data aggressively. For instance, before drilling in a location, Permian Resources will look at all of the adjacent leases to scrutinize the designs of the wells and the performance of each. Then it selects the most-successful components of the neighboring operations and uses that information to plan its own wells. “Our school of thought is let’s go mine every piece of data we can find,” Hickey says. “Then let’s do that again next quarter and next quarter and next quarter.” It’s not that other oil companies don’t use data, but Hickey says there’s a higher level of comfort among members of his generation in letting data drive every decision.

Walter had a slightly different answer: youthfulness makes their oil firm hungrier, more restless. While many companies will consider acquiring drillable acreage only in large blocks, Permian Resources will cobble together smaller opportunities. In the first three months of the year, it closed more than 45 deals, an astonishing flurry of transactions and leases. “We’re willing to do the hard work,” Walter says. “I think it’s not that we take more risks. I think we’re just more willing to do things that other people didn’t want to do.”

Trading at a $7.9B market cap and fresh off of a $4.5B acquisition, they make it look pretty good. And several other “shalennials” have founded land, sand, and investment companies. You have to think there will be more.

Look, I’m not saying people should start a bunch of new oil companies. There are lots of reasons not to start oil companies, and climate change is a pretty big one. But if we’re going to zero out carbon emissions by transitioning to clean energy, you have to wonder what the fossil fuel industry can offer talented people in the meantime. It’s not nothing.

Elsewhere:

Thanks for reading!

Please share your thoughts and let me know where I mess up. You can find me on LinkedIn and Twitter.

I’m not an LCA expert, but a meat’s greenhouse gas footprint also depends on how it’s produced. For example, some claim to produce low-carbon beef.

This was a fun one!

Big fan of using the lens of energy efficiency to look at meat production. Animals are not very efficient!

Also, wow, 73B is so many chickens, maybe souls/kcal should be another metric reported on packaging, lol.

"Beef is coal, pork is oil, chicken is natural gas. Coal/beef and oil/pork have had their ups and downs, but poultry/natural gas have come roaring onto the scene over the last few decades. I’ve never quite known what to do with this information."

Best I can come up with is playing with the correlation between natural gas prices and dairy profitability as influenced by manure digester revenue...

I think the big question posed by the commodity analogy is when/if will traditional meat have its lunch eaten by alternatives the way we're finally starting to see in energy markets w/ renewables..